Risk—and finding ways to reduce it—has been a part of life since people could imagine different futures. Prehistoric granaries were a hedge against the possibility of drought or pestilence. Ancient Greeks created shipping insurance to manage the unpredictability of storms, shipwrecks, and sea monsters. Even Hammurabi’s Code—famous for “an eye for an eye”—includes an early example of a catastrophic insurance policy among its 282 rules.

Not much has changed since. Today’s insurance companies constantly remind us that risk is something to be feared and can only be mitigated with the right coverage.

Yet, when it comes to small businesses, certain risks lead to rewards. Like the risk of starting your own company in the first place. Of expanding into new lines of work. Of buying another delivery truck. Of hiring an extra employee. For these owners, insurance isn’t a way to stop bad things from hurting their business—it’s how they get their business to its next goal. And the next. And the next.

NEXT Insurance realized that the red-tape and high-fees of traditional business insurance— along with the loss of time, money, and opportunity they lead to—were as much a negative risk to small businesses as any mishap. Their digital-first, AI-backed platform not only gets owners the proper coverage fast—including on the job in real-time—but at a cost that makes it feasible for people to do more things with their companies.

THE CHALLENGE

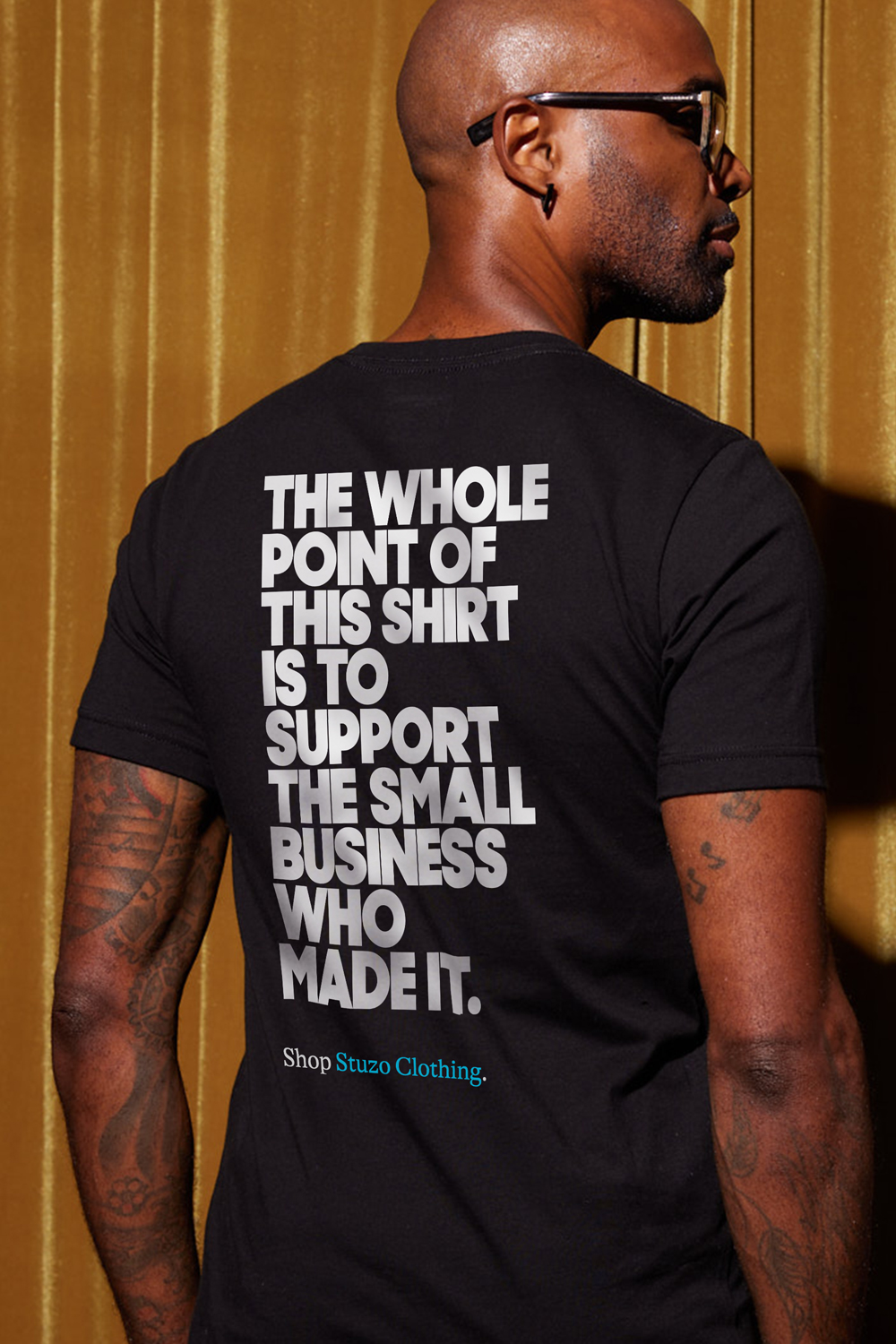

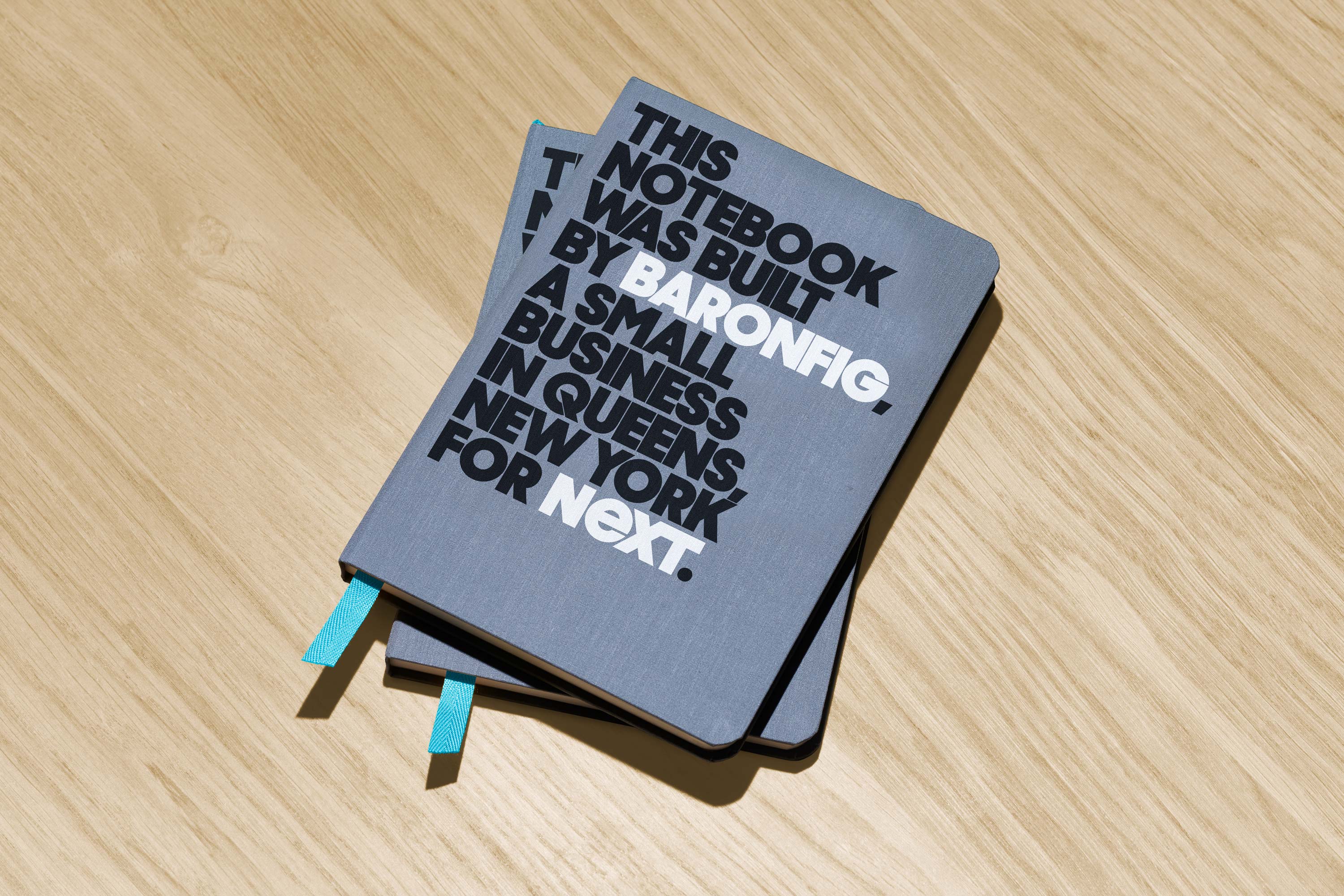

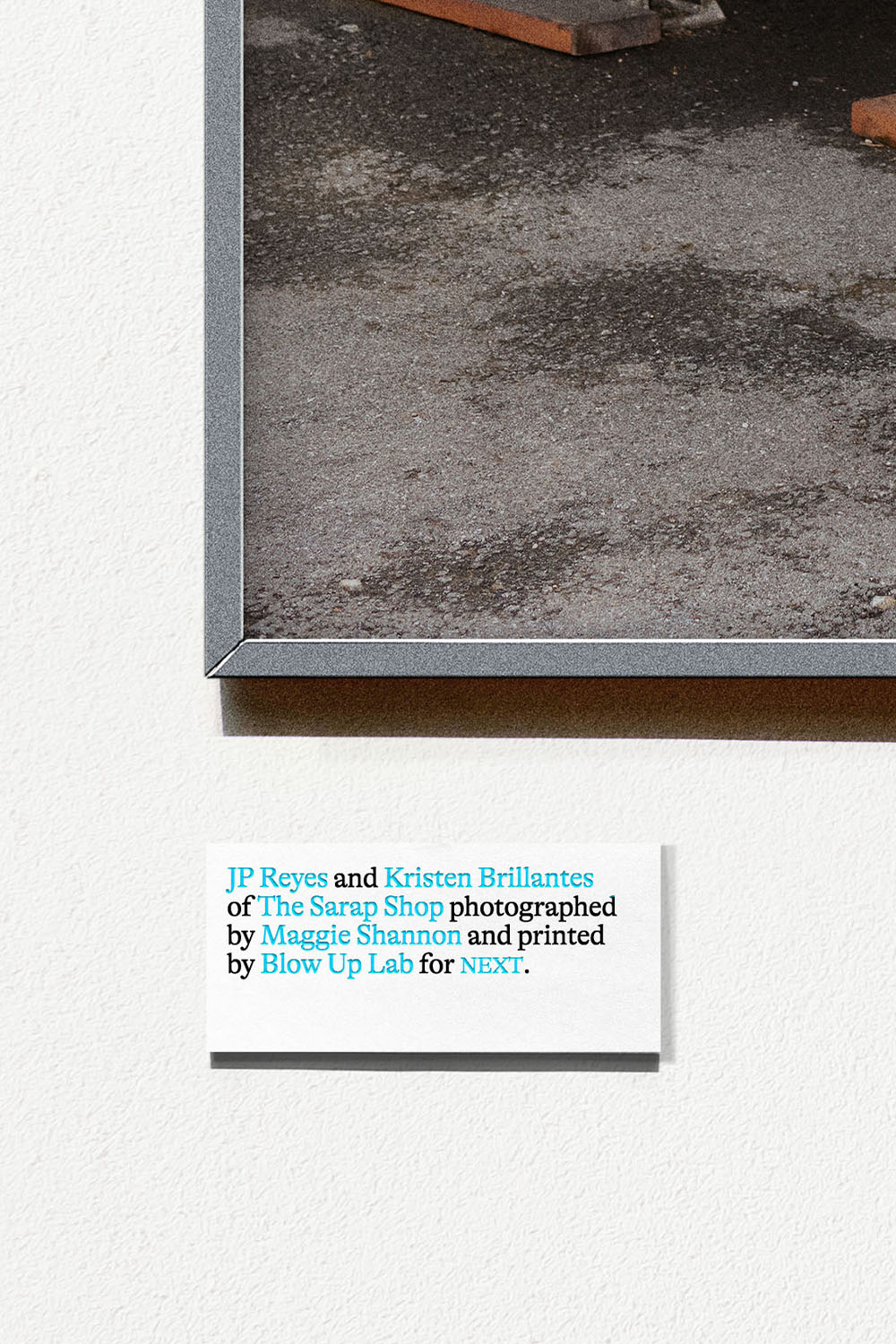

NEXT’s problem wasn’t with small businesses. Thousands of small businesses love the coverage they offer, and NEXT makes it a point to use small businesses (whether they’re NEXT customers or not) for as many services as they can—from hanging drywall in their offices to supplying their coffee.

NEXT’s real issue was with the insurance industry—or at least its marketing departments. As a new-comer, how could they create a brand that stood out in a category that seemed to have only two ways to talk about itself? Insurance companies are either your overly-earnest protectors from doom, or rely on the absurdity of animals and athletes to help you remember them. That’s when NEXT invited us to help them find a third way.

On the surface, our challenge was to brand a start-up insurance company, but there was a larger one underneath it—how could we shift the way small business owners see the role insurance plays in their lives?

THE SOLUTION

As we met with NEXT’s small business customers to understand what they looked for in insurance, we noticed that the most successful owners shared more than just policies—they had optimism and confidence, even in the middle of a pandemic and economic uncertainty.

These owners didn’t need scare tactics or silly jokes to see insurance’s value to their business. They were looking for an intelligent voice that talked about insurance like they did—as a way to improve their business by taking on intelligent risk. We realized NEXT could credibly fill this role by encouraging and enabling owners to use insurance to do more with their companies—thanks to NEXT’s impressive products and the fact that they began as a small business themselves.

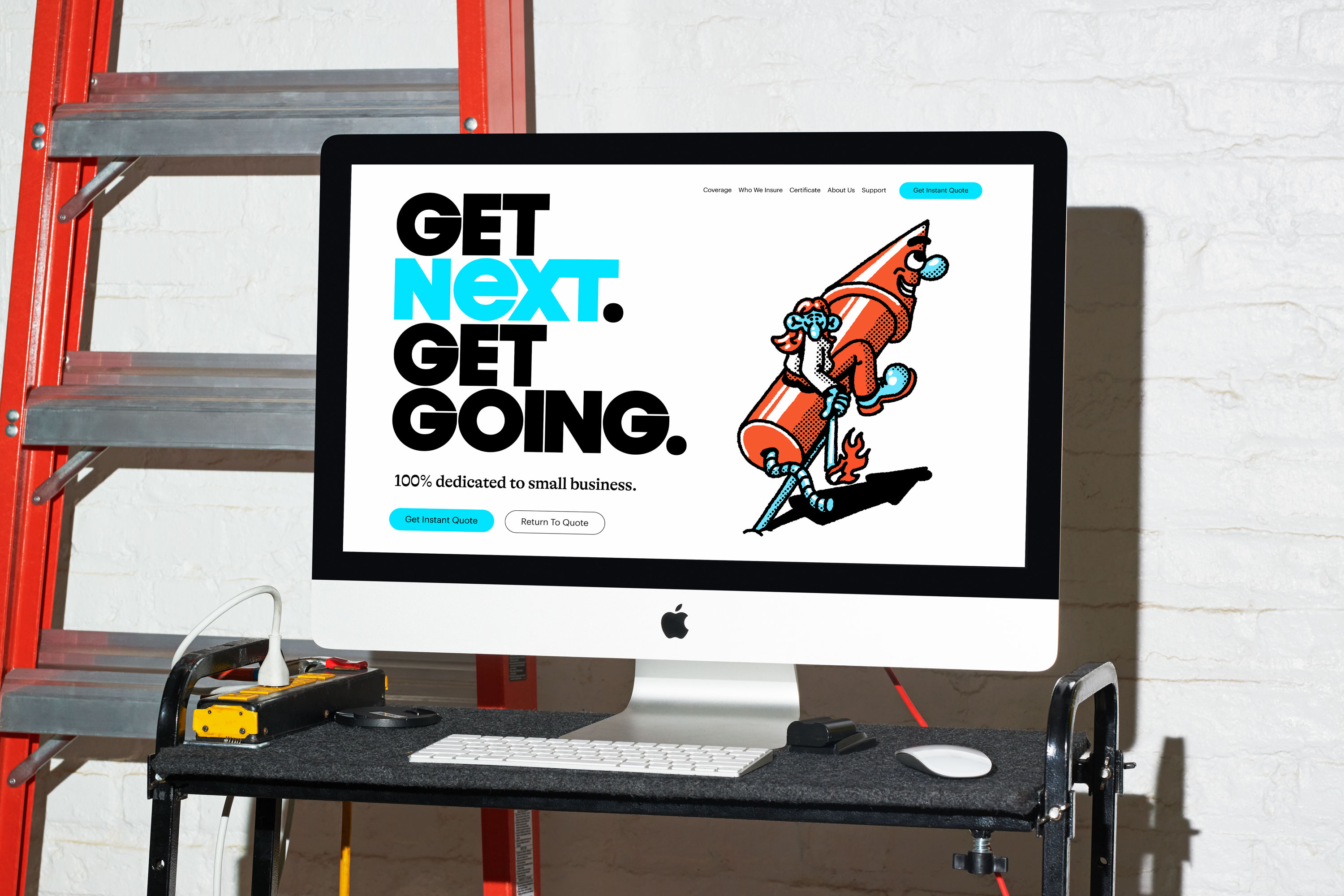

This led us to the line, “Get Going”—a rallying cry that emboldens small business owners to take smart leaps, equips them to seize the right opportunities, and reminds them that we believe they’re equal to any challenges ahead.

Then we crafted a new narrative for the industry—one that sees insurance and risk as tools to help owners proactively build a better business. Rather than fear, it focuses on the opportunities insurance creates for a company. Instead of only fixating on price, it speaks about the ways insurance allows you to do and earn more.

Visually, we looked back to other times when people remained optimistic in the face of cultural and economic turmoil—like the Great Depression of the 1920s and the stifling inflation and tumult of the 1970s. This took us to a playful, hand-drawn style that captures the sincerity, positivity, and gritty can-do ethos of those earlier eras—creating a world that brings to life the possibilities small business owners see around every corner. Paired with a new tone of voice, NEXT is able to add substance to communications and experiences that, we hope, will also make you smile.

The result is a brand that talks about itself and its industry in a different way—online and off, across mass advertising and direct marketing, in social channels and collaborations with NEXT clients—so small business owners can get going wherever they are.